Product Details

Digital Download includes:

- Texas Foreclosure Manual, 2025 ed. in PDF

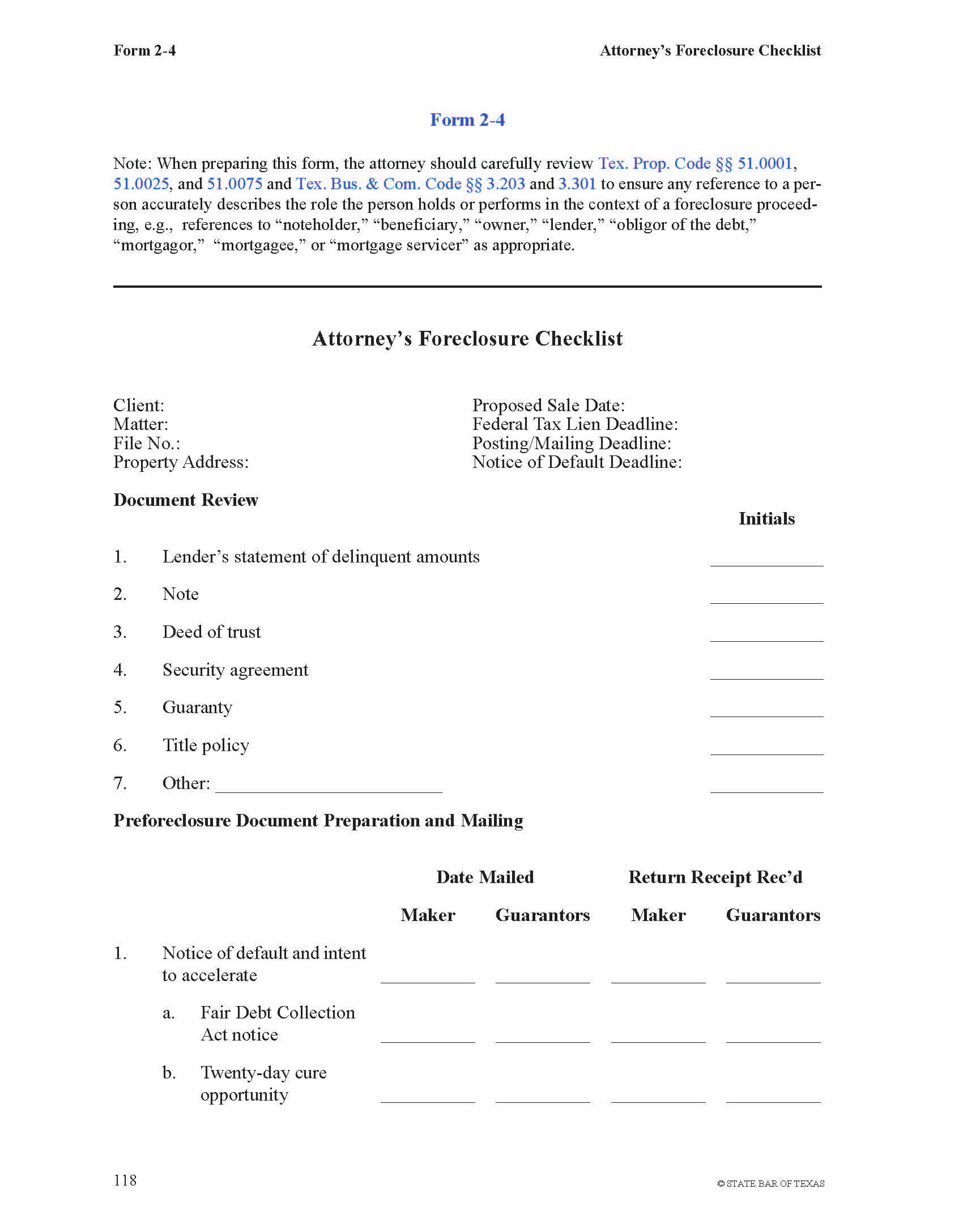

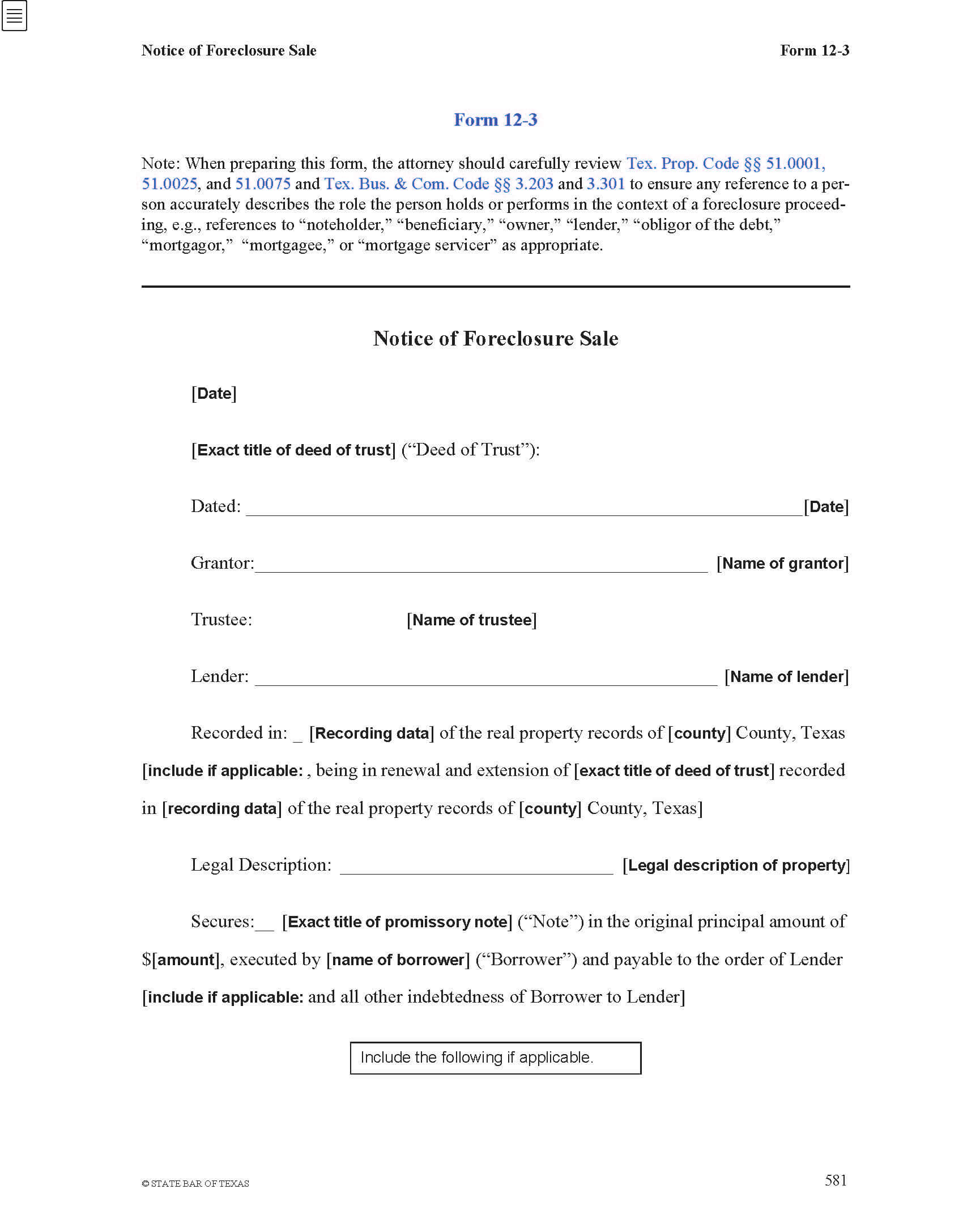

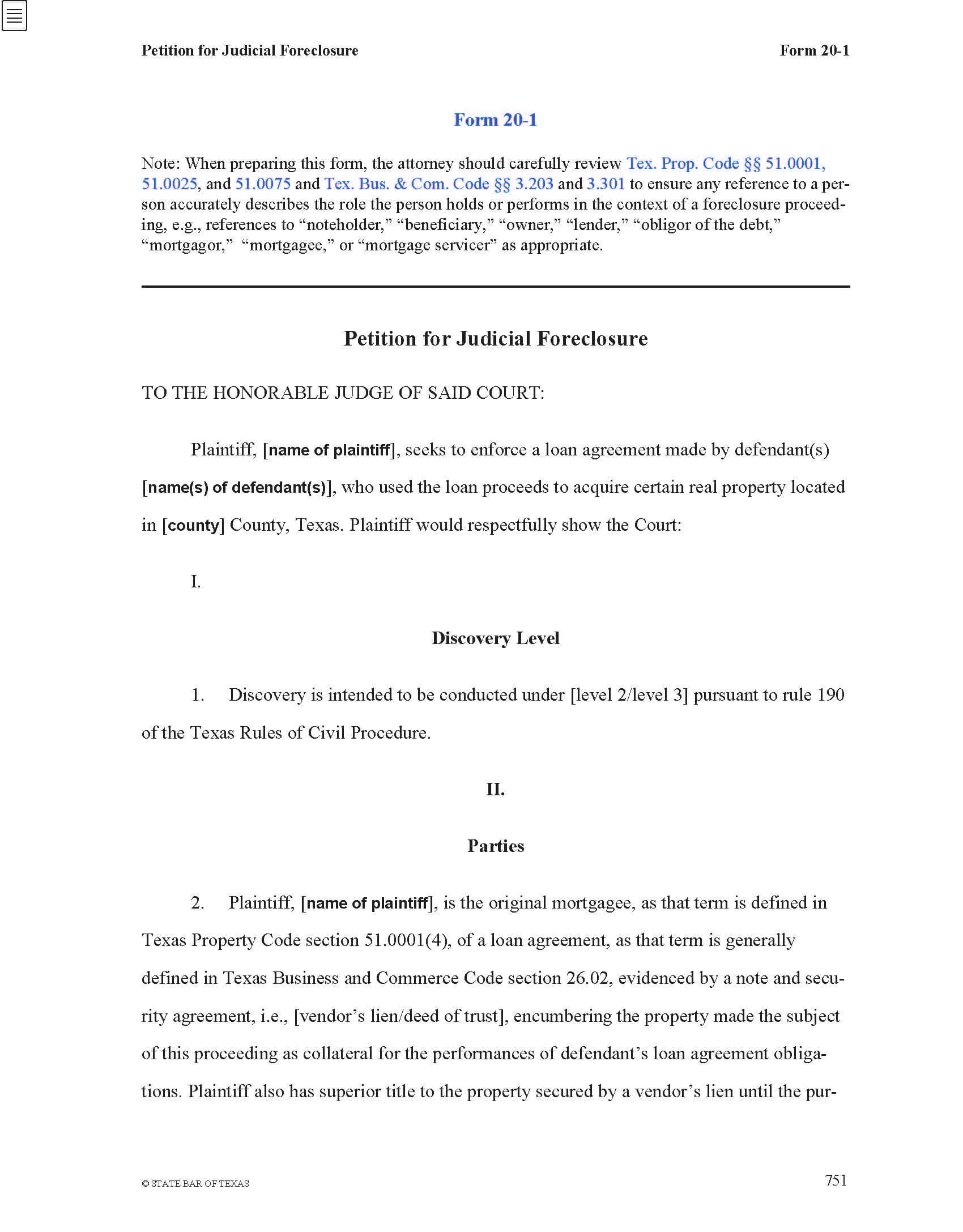

- 124 forms, including:

-

- Foreclosure Calendar

- Attorney’s Foreclosure Checklist

- Loan Purchase Agreement

- Notice of Foreclosure Sale

- Foreclosure Sale Deed

- Judgment of Possession

- Texas and federal case and statutory citations linked to the free Fastcase online database

- State and federal agency forms

- 73 CLE articles of interest

Hard copy book specifications:

- 1 softbound volume

- 1,232 pages

- 124 forms

- Vol. 1: 8 ½” x 10 7/8” x 1.387”

ISBN:

Print: 978-1-956363-69-2

DD: 978-1-956363-70-8

Purchasing Options

The auto-renewal service saves you money and keeps you up to date! By enrolling in this service, you will receive 10% off your purchase today and 30% off future releases of this title. You can manage your auto-renewal status in “My Account” at any time. We will notify you prior to publication of a new release, and unless you opt out at that time, we will ship the new release to you, along with an invoice.

Each additional license allows one additional lawyer (plus that lawyer’s support team) to use the digital download under the terms of the original license agreement. If you enroll in the auto-renewal service, you will receive the discounts described above and your licenses will automatically renew on publication of a new release.

For entity licenses to cover your firm, contact Group and Firm Sales Manager Nancy Van Bramer at 512-263-2802, or email her at nvanbramer@texasbar.com.

Summary of Contents:

Introduction

1 Attorney-Client Relations in the Foreclosure Process

2 Getting Started—Information Required

3 Evaluating the Options for Collecting the Debt

4 Preforeclosure Title Concerns

5 The Note in Foreclosure

6 The Deed of Trust

7 Consumer Debt Collection Laws

8 Demand for Payment, Notice of Intent to Accelerate, and Notice of Acceleration

9 collection of Rent by Lender Before Foreclosure

10 Borrower Challenges to Foreclosure and Lender Responses

11 Trustees and Substitute Trustees

12 Notice of Foreclosure Sale

13 Bid Evaluation

14 Conducting the Sale

15 Postsale Considerations

16 Consequences of Wrongful Foreclosure

17 Suits for Deficiency

[chapters 18 and 19 reserved]

20 Judicial Foreclosure

21 Residential Foreclosure Process

22 Commercial Foreclosure Process

23 Tax Consequences of the Foreclosure Process

24 Foreclosures Resulting from Ad Valorem Taxation

25 Property Tax Loan Foreclosure Process

26 Deceased Mortgager Foreclosure Process

27 Condominium Foreclosures

28 HEL/HELOC Foreclosure Process

29 Manufactured Housing Unit Foreclosure Process

30 Property Owners’ Association Foreclosure Process

31 Reverse Mortgage Foreclosure Process

32 USDA Farm, Ranch, and Housing Loan Foreclosure

33 Servicemembers Civil Relief Act

34 Residential Evictions Following Foreclosure

35 Environmental Issues Affecting the Foreclosure Process

36 Federal and State Foreclosure Assistance Programs

37 Miscellaneous Topics

Appendix A—IRS Collection Advisory Group Addresses and Counties by Areas

Appendix B—Texas County Foreclosure Resources

Contributors

Authors

William H. Locke, Jr.

Ralph Martin Novak, Jr.

G. Tommy Bastian

Sara E. Dysart

LPM Help Center

LPM Help Center